Dave is one of the most popular applications for payday loans and budgeting help, but it is far from the only one. Several applications provide comparable functions, although with somewhat different features and phrases. In this piece, we will discuss some of the top cash advance applications that are excellent Dave alternatives. Most of them, like Dave, offer tiny payday cash advances, but others also offer personal loans if your financial needs are more serious.

Best Dave-like Apps for Cash Advances (2022)

All of the apps mentioned in this post may be found on the iOS App Store or the Google Play Store. Before you start utilising any of the cash advance applications on our list, make sure to look at different possibilities and thoroughly evaluate their features. With that stated, here are some of the top cash advance apps like Dave that you may utilise to borrow money in an emergency.

Dave’s Cash Advance Apps are the best cash advance apps.

Please keep in mind that the applications featured here mostly provide services in the United States. Some, such as Branch, may be available in different markets, although their services and costs may vary dramatically. Before you join up, do your homework. If you live in India and want to receive money from relatives in the United States, learn how to transfer money from the United States to India using Google Pay.

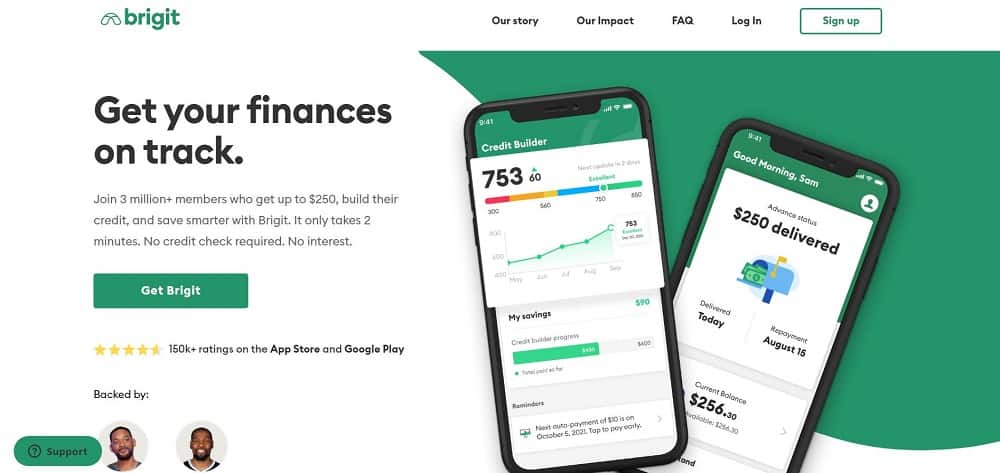

1. Brigit

Brigit, like Dave, is one of the greatest and most popular cash advance applications, providing modest salary advances of up to $250. It does not charge interest on the loan itself, but you must pay a monthly membership fee of $9.99. It is substantially more expensive than Dave, although it does include free account monitoring services. This will contain budgeting tools that will assist you in analysing your earnings and spending patterns.

Brigit works with over 15,000 banks and financial institutions in the United States, including Bank of America, Wells Fargo, TD Bank, Chase, and others. It automatically puts funds into your account when your balance is low and on the verge of falling below zero, so preventing overdraft penalties.

Brigit also provides early repayment choices and due date extensions. The app employs 256-bit encryption and claims not to disclose or sell your personal information to other parties.

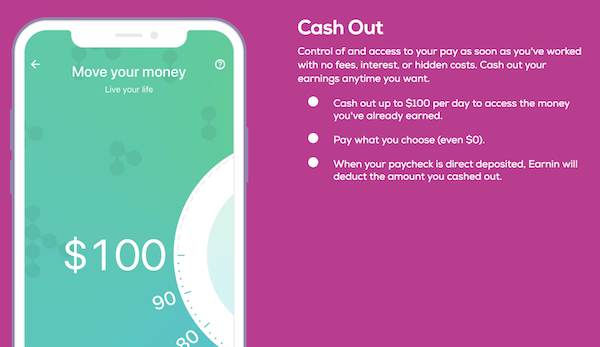

2. Earnin

Earnin, formerly known as ActivHours, is a wonderful alternative to Dave for people who do not want to pay a monthly membership cost. Instead, the app asks you to leave a tip that you believe is appropriate for the service. The app provides paycheck advances of up to $100 every day earned, up to a maximum of $500 per week.

Earnin also has other useful features, such as Balance Shield Alerts, which may inform you if your bank account balance falls below a specific level. There’s also a Cash Out tool that may deposit up to $100 in your bank account automatically to assist you avoid overdraft penalties.

Earnin has certain drawbacks in addition to its advantages. You must have a regular pay schedule to be eligible for paycheck advances (weekly, bi-weekly, semi-monthly, or monthly). For you to be qualified to utilise the service, your company must also have a physical work site or use time-tracking software. You must also direct deposit at least half of your paycheck into your bank account.

3. MoneyLion

MoneyLion is a mobile banking app that allows users to borrow, save, invest, and make money all in one place. With its ‘Instacash’ function, it, like Dave, provides simple cash advances and early paycheck access. It allows you to borrow up to $250 from your next paycheck with no interest or credit check. The firm states that the money will be transferred to your account immediately, regardless of the time of day. Its RoarMoney function also allows you to receive your paycheck up to two days ahead of schedule.

MoneyLion’s biggest feature is that there is no minimum balance requirement. There are no fees for normal transfers, foreign transactions, mobile check deposits, or card replacement using the app.

Furthermore, the app assists you with your investments by allowing you to move money from your savings account into exchange-traded funds that are tailored to your requirements and risk tolerance. A basic subscription to the app costs $1 per month, while its ‘Credit Builder Plus’ membership, which provides access to loans of up to $1,000, costs $19.99 a month.

4. Branch

Branch, one of the top cash advance apps like Dave, also provides personal loans in the majority of the nations in which it operates. It provides a cash advance of up to $150 each day or up to $500 of your salary in the United States. It provides no-fee checking, a debit card, and free ATM access at over 40,000 locations across the United States. You may also use the Branch app to receive money, transfer payments, and pay bills. It costs $2.99 to $4.99 for quick debit card advances, while conventional bank account advances are free and take up to three business days.

The branch app offers useful features, but its cash advance service has severe conditions. To begin, you must have earned a pay from the same company for two months in a row. You should deposit money into a checking account with a bank that accepts debit cards and have a debit card for that account. Unfortunately, the app does not cater to remote workers. That implies that if your employer does not have a physical location, you will most likely be unable to utilise the app.

Branch provides its services in a number of different countries, including India, Kenya, Nigeria, and others, in addition to the United States. In most of these markets, the app provides personal loans with interest rates ranging from 0% to 360%. You may pick payback durations ranging from 60 to 336 days depending on the amount of your loan. In India, the app provides free monthly CIBIL scores as well as tailored suggestions to assist you in monitoring your credit and staying on top of your finances.

5. Even

Even, another cash advance apps like dave, works with thousands of employers that have joined with the firm to provide you with money on-demand. There is no interest involved, but the app charges a $8 monthly subscription fee. However, some companies subsidise part or all of that expense. In addition to cash advances, the Even app assists you in budgeting from salary to paycheck and gives reminders about forthcoming bill payments and how much you need for them.

It’s worth noting that Even is only available through chosen employers that have collaborated with the app. It also collaborates with over 18,000 banks for its InstaPay service, which transfers money into your bank account within one business day. However, unlike some of the other applications on this list, the Even app does not distribute loans. It just gives you instant access to money you’ve previously earned.

6. Empower

Empower, another popular apps like dave , provides interest-free financial advances of up to $250. The funds can be transferred for free to your Empower checking account or for a cost of $3 to a bank account. There are no late fees or credit checks with the Empower app. It does, however, require a membership fee of $8 per month after a free 14-day trial period. Furthermore, in order to be eligible for cash advances, you must make frequent direct deposits to your Empower Checking Account.

Another important feature is the Early Salary Deposit option, which allows customers to obtain their paycheck up to two days earlier. It also provides a 10% cashback rebate on qualified purchases made at hundreds of restaurants, grocery shops, and petrol stations.

Along with the cash advance and associated features, the Empower app also serves as a budgeting app, assisting you in setting spending limits depending on your income. It also recommends an overall spending limit for each category and provides you notifications when your spending is close to exceed the limit. You will also receive monthly reports detailing your spending in each category.

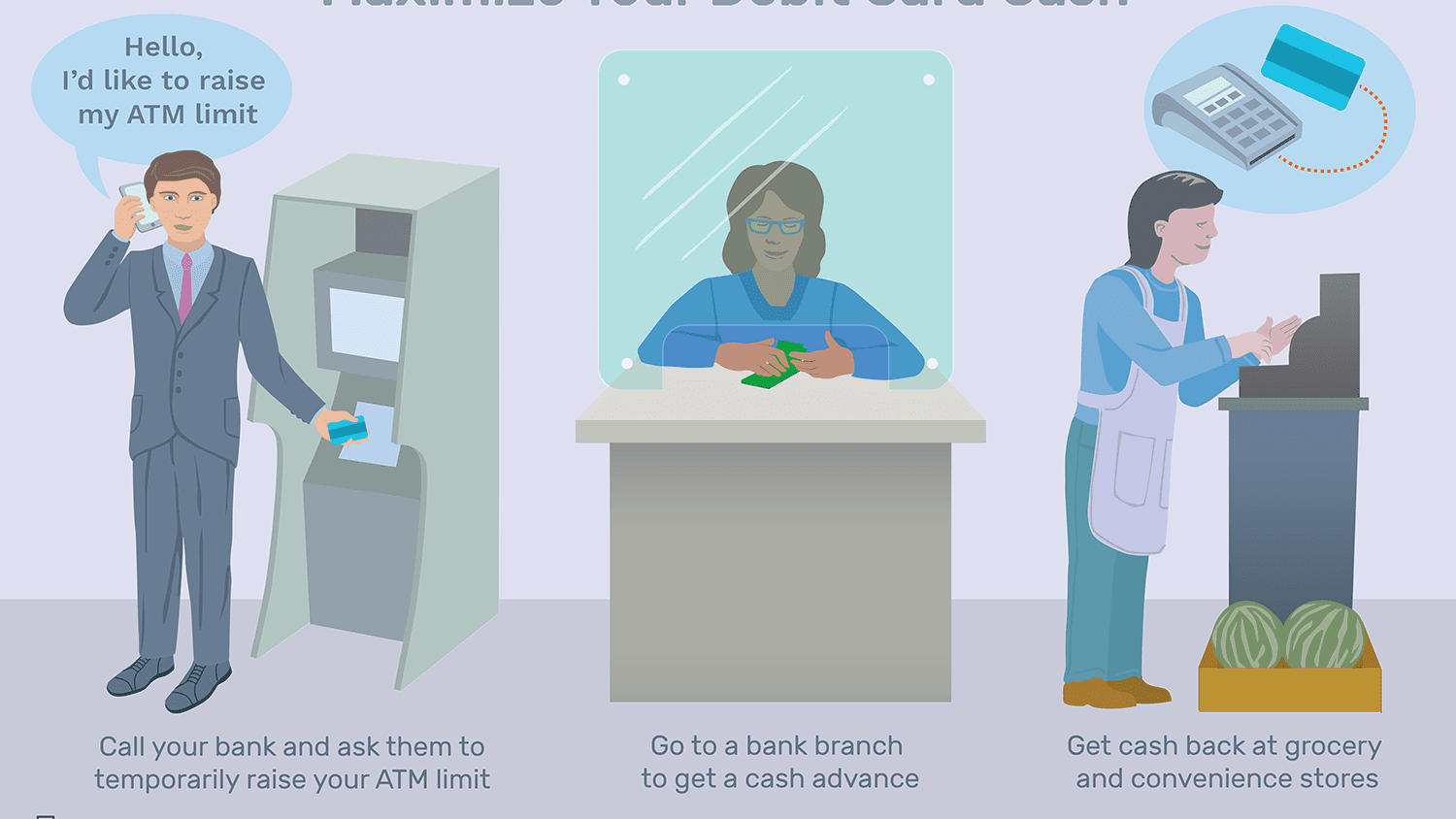

7. Axos Bank

Axos Bank, unlike some of the other apps on our list, is a full-service digital banking service that provides high-yield checking and savings accounts. You can also acquire investment alternatives, loans, personal money management, and other services. While Axos does not provide a real cash advance, it does have a function called Direct Deposit Express. It allows you to access your money up to two days before your company deposits your paycheck into your bank.

Axos also provides ‘Payback Checking,’ which allows customers to earn up to 1% cashback on all signature-based purchases. Furthermore, as part of its financial services offering, Axos allows you to deposit checks, transfer payments, and pay your bills on time. It also makes investment suggestions based on your risk tolerance.

Two-factor authentication (2FA), Face ID, fingerprint (or Touch ID on Apple devices), and account monitoring are among the security features. There are no monthly service fees or overdraft fees with this app. Axos Bank does not have a minimum balance requirement, however you must have at least $50 to create an account.

8. DailyPay

DailyPay is the next app on our list of the top cash advance apps like Dave. This app allows you to view your pay stubs before your next paycheck. It, like Even, provides Earned Wage Access and must be sponsored by your company. DailyPay, like other applications in this category, allows you to rapidly transfer your unpaid earnings to your debit card, bank account, prepaid card, or paycard.

DailyPay deposits the funds into a bank, and the amount previously withdrawn is deducted from the paycheck on payday. It does, however, demand a $2.99 fee to utilise the service.

DailyPay’s payment network and customer service channels are PCI-compliant and SOC II-audited, and it employs 256-bit encryption. It is a well-known brand, having received a ‘honourable mention’ on Fast Company’s ‘World Changing Ideas’ list this year. Burger King, Uber, Doordash, and ShiftGig are among the main firms that provide employees with early access to their pay through DailyPay.

9. Chime

Chime is another app that provides users with Earned Wage Access. It functions similarly to Even and DailyPay in that it allows you to access your salary two days before the scheduled payment date. It does not offer you with a cash advance, apps like dave did. Chime is a free service with no monthly fees, minimum balance fees, or international transaction costs.

You may also use the Chime app to send money to friends, family, or roommates with no transfer fees. With Moneypass and Visa Plus Alliance, it provides consumers with access to over 38,000 ATMs across the United States. However, you must pay any relevant out-of-network ATM withdrawal costs.

Chime also offers a ‘SpotMe’ option, which allows all qualified customers to overdraw their accounts up to $200 based on their repayment history. To utilise SpotMe, you must have received $500 or more in direct payments in the previous 31 days. Another noteworthy feature is the money-rounding tool, which will automatically round up the change to the nearest $1. For example, the app would charge you $15 for a $14.49 transaction, and the extra 51 cents will be instantly deposited to your savings account.

10. PayActiv

PayActiv is the final app on our list of the top advance cash apps like Dave. It is also intended towards companies, who may utilise the service to provide their employees early access to their earnings, similar to DailyPay and Even. People whose employers are not engaged with Payactiv, on the other hand, are also entitled to access its services. In such situation, you may apply for the PayActiv card and get your paycheck up to two days ahead of schedule. PayActive’s savings features, medication discounts, and financial advice are available to all users.

People who use PayActive at work will see their ‘hours worked’ and current earnings on the app. They can also transfer the available money to their bank, credit card, or cash. The funds obtained through the app will be taken from their next paycheck. Payactiv, like other applications in this category, leverages time and attendance data to offer employees with earned income access. PayActive’s noteworthy partners include Subway, Uber, Hilton, Pizza Hut, Walmart, Murphy USA, NYC Taxi, and others.

Alternatives to Dave App for Cash Advance

Many financial aid apps, such as Dave, provide modest cash advances and personal loans to help you acquire a few additional dollars in an emergency. Some of the applications on this list also provide access to financial instruments, banking, investing, stock trading, and other services. While we have done our best to provide accurate and up-to-date information for all of the applications on this list, our post is solely for general informative reasons. It is not intended to be a substitute for expert guidance. So, before handing over your financial information to the businesses indicated above, make sure to conduct comprehensive investigation.